Freehold Capital Partners, a company started in Texas, is selling developers across the country on a plan that would attach a private transfer fee to homes, allowing developers to profit for generations.

The fee, written into neighborhood restrictions, would encumber the property for 99 years and throw 1 percent of the sale price back to the developer — or his or her estate or another investor — and Freehold each time the home changes hands.

It's an idea that's drawn the attention of some state legislatures and real estate trade organizations, which are fighting to stop the transfer fees from gaining a spot in the market.

Critics say such fees could taint entire neighborhoods, making it difficult to sell homes, and could complicate title records for decades. If the fee is not paid by the seller, a lien is placed on the property and the title becomes muddy.

And then there's the basic question: “What it comes down to is, 20 years later, why is the developer still profiting?†asked Jeremy Yohe, director of communications with the American Land Title Association, the national association for title companies.

Freehold, which started in Austin, compares the transfer fees to mineral rights and calls land development a creative process on par with writing a book.

“Just like authors who write books and musicians who write songs that will be enjoyed for generations to come, those who improve property are also engaged in the creative process, and the economics of the transaction should reflect that reality,†a Freehold brochure says.

Freehold says it has signed up developers, including many across Texas, who hold more than $500 billion in residential and commercial property — but it will not name any of them.

Because courthouse property records are filed by owner name, it's difficult to track the company's activities in Texas and know which developers have signed on to the program.

Title companies that have been watching Freehold say it's possible that a homeowner could have a transfer fee in a neighborhood covenant and not realize it until he or she resells a home. Even if a transfer fee were to turn up in a title search, few people read all the neighborhood covenants and restrictions before signing.

A spokesman for Freehold says the company favors clearly disclosing private transfer fees in a standalone document. But in Texas, there's no legal requirement to do so. And under the standard real estate contract in Texas, home buyers agree to accept any restrictions that are common to the subdivision.

Freehold founder Joe Alderman refused requests for an interview, and spokesman Curtis Campbell would only answer questions by e-mail.

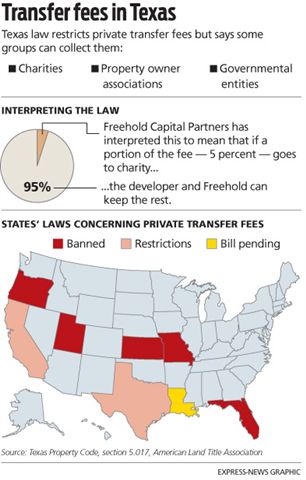

In response to the company's sales pitch, Texas lawmakers have passed restrictions on private transfer fees, but they are not banned. Some other states have banned such fees outright.

The American Land Title Association and the National Association of Realtors wrote model legislation banning private transfer fees that members can present to legislators. And last week, the trade groups asked the U.S. Housing and Urban Development Department to clarify that it prohibits the use of private transfer fees on government-insured mortgages.

“It's a limit on property. If you don't pay the fee, the property doesn't transfer, and you don't have clear title,†said Gerry Allen, community outreach manager with the National Association of Realtors. “There's nothing to say that anybody who owns a home can't attach this to their property. You could have a whole chain of these.â€

Legislative efforts

Florida, Oregon, Missouri and Kansas have banned transfer fees in recent years. This month, Utah legislators banned them, and a bill to do the same is pending in Louisiana.

Texas law restricts private transfer fees but says some groups can collect them, including charities, property owner associations or governmental entities.

Freehold has interpreted this to mean that if a slice of the transfer fee — 5 percent — goes to charity, the developer and Freehold can collect the rest.

“This industry felt like they could create a nonprofit and get around it,†said Trent Thomas, chief of staff for state Rep. Drew Darby, R-San Angelo. Darby owns a title company and has sponsored legislation to try to further restrict private transfer fees.

After the California Association of Realtors learned about transfer fees, the trade group took the issue to state lawmakers in 2007.

“I could put one in my deed that would require every future (seller) to pay a fee to me personally,†said Alex Creel, senior vice president of government affairs for the group. “We used to joke that you could create a college fund.â€

But developers aligned with environmental groups and affordable housing advocates, promising that a percentage of the fee would help set aside open space or create affordable housing. It proved an unbeatable coalition, and CAR settled for a law that requires clear disclosure of transfer fees.

“We had 210,000 members at the time, we have a big PAC, lots of money, lots of resources, four lobbyists. We have a very sophisticated operation. We couldn't beat it,†Creel said. “We couldn't believe it. It just seemed like such a bad idea.â€

The largest private transfer fee Creel has seen was 1.75 percent in a community where homes sell in the range of $800,000 to the low millions — meaning homeowners will have to pay a fee of around $17,500 when they sell their homes.

Patent pending?

Freehold was based in Austin before moving its headquarters to New York this year to be at the “heart of the financial markets.â€

While the company says it has a patent pending, the U.S. Patent and Trademark Office denied the patent last year and lists the application as “abandoned.â€

Company spokesman Campbell said by e-mail that Freehold has filed a continuation patent to pick up the claims of the first patent.

The company name makes reference to English law — “freehold†essentially means outright property ownership.

A few years ago, a predecessor company called Freehold Licensing tried to sell individual homeowners, as well as builders and developers, on the idea of transfer fees.

“Maybe you planted a tree, added on a room or rehabbed a home,†the Web site said in 2007. “Fifty years from now, when a family is enjoying the property that you improved, and making a profit by selling the property you improved, why shouldn't you benefit? Of course you should.â€

Founder Alderman put a transfer fee on his own nine-bedroom home in Round Rock in 2005, according to public records. He took it off in 2009 when the home was listed for sale.

An e-mail from Campbell said the timing was coincidental. But, he said, “one of the things we like about our program, and which resonates well with developers, is that they can terminate the instrument if they decide to do so.â€

Today, Freehold markets to large landholders — not individuals — and says it will create a secondary market for selling the rights to transfer fees.

The idea is that developers would get money upfront from investors, who would get a 99-year income stream.

The pitch

The Freehold pitch sounds good to many in the industry who need money now to finance a project.

“It's a phenomenal plan,†said Greg Blume, a Houston-based developer who plans to use transfer fees in the Savannah Plantation development in Brazoria County. “It's just one more way of trying to finance and fund any type of real estate project.â€

Selling transfer fee rights to investors would mean a developer could add more amenities to a neighborhood or sell for less than the competition — or both. “It just makes sense,†Blume said. “You can do more for the project and have less debt.â€

Blume said developers in all the state's major markets are signing up with Freehold. There's no cost to sign up, but because there's no secondary market, no one has seen any money.

San Antonio subdivision developer Norman Dugas talked to Freehold representatives a few years ago. But he decided such fees would create too much of a marketing hurdle.

“The guy across the street, the competition, is going to say, ‘Those guys are sticking you with this transfer fee,'†Dugas said. “I just don't quite think it's going to go over. For the fee to work, it would have to be so desirable or attractive a property that people just had to get in there.â€

Reader Comments

http://www.mysanantonio.com/news/Private_transfer_fees_plan_would_pay_developers_for_99_years.html