|

Report Mortgage Fraud

SEE:CONGRESSIONAL OVERSIGHT PANEL

Action Alert! HelpWithMyBank.gov.

Resourse:Good Grief America http://goodgriefamerica.ning.com/

Get Answers About National Banks And File Complaints

Featured News Report

Housing Bubble Gone Bust

Predatory Lending, Foreclosures, Housing Crisis & Bailouts

FBI reports mortgage fraud rose 60% in year

Did your builder offer you incentives to persuade you to use their Mortgage Company and Title Company? Were you charged a high interest rate? Contact us:

This e-mail address is being protected from spam bots, you need JavaScript enabled to view it

If you have been coerced into using a builder's affiliate, call the RESPA enforcement staff at 202-708-0502 or e-mail

This e-mail address is being protected from spam bots, you need JavaScript enabled to view it

. For background on RESPA, visit www.hud.gov. KENNETH HARNEY, based in Washington, writes on national housing issues. His e-mail address is

This e-mail address is being protected from spam bots, you need JavaScript enabled to view it

.

! Pulte Arizona Consent Order - $1,181,400 settlement ! Pulte Arizona Consent Order - $1,181,400 settlement

August 9, 2010

ATTENTION: Check your mortgage ducuments.

Pulte homes and lenders have a legal obligation to provide their customers with complete and accurate information. Pulte has commited to amend its practices and bring more transparency into buying and financing a Pulte home.

The Consent Judgment stipulates that Pulte will:

►Ensure that Pulte Home’s Arizona sales representatives do not represent or imply that they are able to “pre-qualify†Arizona consumers for home loans.

►Disclose orally and in writing that communications between a prospective buyer and Pulte sales staff regarding how expensive a home the consumer can afford to buy do not constitute an offer of financing.

►In one document, clearly disclose: (1) Pulte offers buyers incentives, such as free upgrades or money toward closing costs, in exchange for the buyers’ use of Pulte Mortgage or other affiliated businesses, and consumers who do decide to use a lender other than Pulte Mortgage will not receive such incentives or discounts. (2) There are other providers of such services, and fees, charges, loan terms and interest rates may vary among providers.

►Ensure that the representations made in its English-language and Spanish-language marketing materials are equivalent.

►Refund $81,400 to 10 Arizona consumers who the Attorney General alleged wrongly forfeited their earnest money deposits after canceling their purchase agreements.

►Pay $200,000 into an escrow account which will fund any new, legitimate claims for earnest money deposit refunds that are filed with the Arizona Attorney General’s Office within 12 months of the settlement.

►Pay $500,000 to the Consumer Fraud Revolving Fund to fund the Attorney General’s consumer protection, education and outreach programs.

Washington Post: Beware of Builders Bearing Gifts and Pushing Lenders

Builders can't force you to use any particular lender; federal law prohibits it. Nor can they dictate whom you must use for other settlement services, such as the title company or homeowner's insurance provider... Ryland Homes, for example, has an in-house mortgage company, Ryland Mortgage, which deals only with people borrowing to buy a home built by Ryland. Brookfield Homes, the company offering as much as $100,000 in concessions, owns a mortgage subsidiary called the Mortgage Group. Although the law says builders can't force you to use their in-house lenders, nothing says they can't do their best to entice you to keep all your business under their roof. Read more...

Mortgage Financing: Signs Of Predatory Lending

If you're shopping for a home loan, you can save thousands of dollars by being aware of predatory lending practices, in which you're charged too much for your loan or are forced to buy services you don't really need. You can protect yourself by learning to recognize the signs of predatory lending. The Center for Responsible Lending lists seven specific warning signs that consumers should be aware of when applying for a mortgage. Read More...

Did HUD Ex-Secretary Cisneros Help Mastermind Predatory Lending

"Henry Cisneros on the hot seatâ€...A predatory lending scheme that many experts predict could eventually lead to the worst recession to hit this county, and possibly the entire financial world...which ultimately compensated him generously... after leaving HUD Cisneros became a KB Home board member as well as a Countrywide board member. He created American City Vista, an affordable housing joint venture with KB Home, as KB Home began construction on the disastrous Mirasol project that cost taxpayers millions, of which $5M is still missing. Read More... Plus: Express-News on the Hot Seat...

A Recipe for enormous profits, defective homes and foreclosure disaster Shoddy or not, for the past ten years homebuilding has remained the chief indicator holding up the economy, and from the President to Congress no one wanted to disrupt the money flow. The result is the homebuilding industry grew more powerful and confident in building defective homes without consequences. Read more...

Understanding Easy Big Money and Kickbacks in Mortgage Lending

A seemingly arcane policy change by mortgage investor Freddie Mac sheds new light on issues of much broader concern for consumers: Do you really understand where the money is flowing -- all the nooks and crannies -- when you take out a mortgage and pay thousands of dollars in fees at settlement? Is anyone required to explain to you what's really going on inside your home loan -- how it works and whether it could morph into something very different? Freddie Mac's policy change announced Feb. 14 affected a dark corner of the mortgage business -- splits of mortgage insurance premiums between lenders and insurers. What? My lender is getting a cut of the premium, you ask -- just as builders and realty brokers are pocketing chunks of my title insurance premiums behind my back? Read more...

Report Mortgage Fraud:

WWW.NAMB.org - National Association of Mortgage Brokers/FBI

With the homebuilders owning their own mortgage companies and choosing their appraisers, creative financing has blossomed.

National Mortgage Fraud Law Firm

- National Law Firm Established to Handle Mortgage Fraud Cases A new national law firm, The American Mortgage Law Group, has been established to focus exclusively on the needs of the mortgage banking industry...

In Texas:

WWW.SML.STATE.TX.US - Texas Department Savings and Mortgage Lending The Texas Department of Savings and Mortgage Lending is an agency of the State of Texas and is subject to the oversight and jurisdiction of the Finance Commission of Texas. The Texas Department of Savings and Mortgage Lending (the Department) accepts signed, written complaints against mortgage brokers, loan officers, mortgage bankers, and state savings banks. File a complaint

Attorney General of Texas - Important Mortgage Fraud Information

Mortgage fraud bilks financial institutions, but it can also be devastating for borrowers and their families. It is, moreover a criminal offense. In 2007 the legislature passed HB 716, that directs the Attorney General to establish a Residential Mortgage Fraud Task Force to investigate and prosecute residential mortgage fraud and the perpetrators of mortgage fraud statewide.

Attention:Texas Attorney General Investigating Washington Mutual

File a complaint with the Texas Attorney General - Hundreds of customers of the mortgage giant complain they are getting socked with unnecessary fees and threats of foreclosure. If you have a complaint against Washington Mutual, you should direct those complaints to the Texas attorney general at 512 463-2100 or www.oag.state.tx.us. Read more...

Learn More: Invaluable Sources of Information on Loan Fraud

Mortgage Servicing Fraud.org This nightmare is orchastrated by a growing number of well-known, corrupt and ruthless mortgage servicers who manufature defaults on perfomring loan to then flood the account with illegal fees strategically designed to STEAL the borrower's equity -- and ultimately the property. In addition, the borrower's credit is destroyed to prevent them from financing with another lender. Read "The Issue".

Mortgage Fraud Blog - Central clearinghouse for information on recent mortgage fraud schemes, indictments and prevention.

Stop Mortgage Fraud.com See: A Borrowers's Bill of Rights -The Warning Signs of Abusive Lending - Report Abusive Lending Stop Mortgage Fraud.com See: A Borrowers's Bill of Rights -The Warning Signs of Abusive Lending - Report Abusive Lending

The Mortgage Fraud Blog - For Fraud Prevention Professionals - supported and funded by The Prieston Group. A great source for up to date information.

Prevent Mortgage Fraud - "My story of a being mortgage fraud victim and my courses, in general, are designed to arm you with the tools you’ll need to combat the forces of those who would commit fraud."

FBI Investigation of Mortgage Fraud

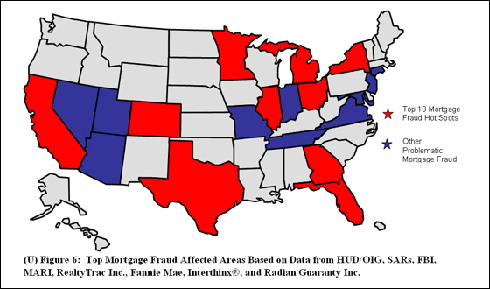

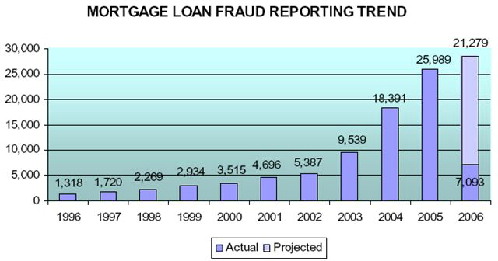

THE RISE OF MORTGAGE FRAUD

How It Impacts You

206 FBI indictments/informations (down from 241 in Fiscal Year 2004).

170 FBI convictions (consistent with 172 convictions in Fiscal Year 2004)

$1,014,000,000 (FBI) reported loss (up from $429,000,000 in Fiscal Year 2004.

Read more...

Beazer Homes and Fraud

Insurance Company Seeks Declaratory Judgment that it is not obligated to Defend Beazer Homes in Fraudulent Home Sales

A class action lawsuit has been filed in the Southern District Court of Indiana against Beazer Homes Investment Corporation, Inc. Hanover Insurance Company seeks a declaration that the it is not obligated or required to defend and indemnify Beazer Homes as an insurer because of Beazer's alleged fraudulent activity.Read more...

Reader's Digest - Cheated Out of House and Home

Don't let these scams happen to you!

The term mortgage fraud encompasses a grab bag of cons and tricks, perpetrated on victims ranging from average homeowners to novice real estate investors to savvy bankers and the banks they represent. It is, according to FBI Special Agent Ronda Heilig, "one of the fastest-growing white-collar crimes in the United States." ...Mortgage fraud has been around as long as home loans, but recent trends have made it easier -- and far more lucrative -- to game the system. Here's what's driving the crime spree...Avoid Being Scammed Read more...

_________________________________________________________________________

The Birth of Mortgage Fraud Scams Deregulation by HUD – a temptation for the homebuilding industry

A Message from Janet Ahmad

Over the past decade homebuilders have established an affiliation with mortgage institutions and created their own mortgage companies. Using unscrupulous appraisers to inflate values and creative financing techniques, mortgage fraud has flourished, causing home foreclosures rates to skyrocket.

See: HUD's Broken System - Deregulation

Beware of Builder Gifts and Incentives

Builder discounts on the price of the home, washer, dryer, and refrigerator, big screen TV’s and gift cards are the common incentives offered by the builder to entice buyers to use a particular mortgage company that usually charges a higher percentage rate. If it sounds too good to be true, it probably isn't.

Easy to fall victim to scams – “0†Down Lures Buyers – Builders Target and Over-Qualify Naive First-Time Buyers

Most homebuilders have a well-trained staff of professionals who often make it easier to buy a home than obtaining a credit card or a new car. The builders staff does all the work while the buyer’s attention is shifted to the fine details of the more expensive upgrade items, granite counter top, tile, energy savings features and of course the incentive appliances for using the builder’s friendly mortgage company. Concurrently, the friendly and creative financial staff gathers what they refer to as “pre-qualification†information by obtaining credit and income figures from the buyer.

The objective is to skillfully prepare the electronic financial statement for the buyer that will ultimately become buried in the vast paperwork of the “rushed†closing, so as not to draw attention to the inflated figures inserted that incorrectly state the buyer’s income. Routinely, the closing is rushed by over-worked staff of the builder-owned Title Company that dangles the key to the American Dream over the complex stack of papers for homeowners to sign, who are more worried about the furniture in the moving van headed to the house.

If caught, the mortgage company simply directs the blame to the buyer by explaining they only inserted the information that was provided to them. Knowing that the chances of getting caught are slim, builders and their associates simply ignore lending guidelines and over-qualify the buyer. The intent is to sell houses, regardless of the means.

Detecting Mortgage Fraud – Having trouble making your mortgage payment?

Check your closing papers, particularly your financial statement for accuracy of income and net worth.

Foreclosures are at Epidemic Proportions

Mortgage fraud is easily hidden. Homebuilders dismiss the high foreclosure rates in new subdivisions by blaming the economy, higher interest rates, loss of jobs, and then even accuse buyers of greed and overindulgence when buying a new home. See: Foreclosure News

_______________________________________________________________________

Foreclosure Reports:

See Special Reports - KB Home Foreclosure Rate More Than Double Other Builders.

_______________________________________________________________________

|

Home

Home  Report Mortgage Fraud

Report Mortgage Fraud  Home

Home  Report Mortgage Fraud

Report Mortgage Fraud