In borrowing, some face a tougher climb

Blacks, Hispanics more likely to receive higher interest rates

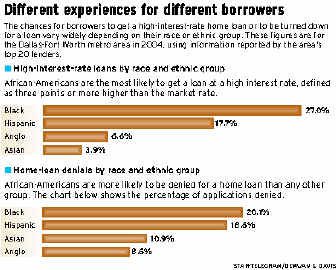

Federal data provided by the 20 largest mortgage lenders show that African-American borrowers in the Fort Worth-Arlington and Dallas metropolitan areas were more than four times more likely to get a high-rate mortgage than Anglo borrowers. Such loans carry an interest rate at least 3 percentage points higher than the market rate. Hispanics are nearly three times more likely to get such loans.

Ft Worth Star-Telegram

In borrowing, some face a tougher climb

Blacks, Hispanics more likely to receive higher interest rates

By JIM FUQUAY and JEFF CLAASSEN

STAR-TELEGRAM STAFF WRITERS

Sun, Sep. 11, 2005

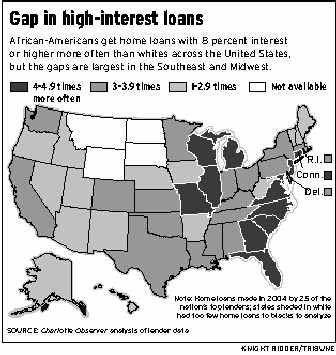

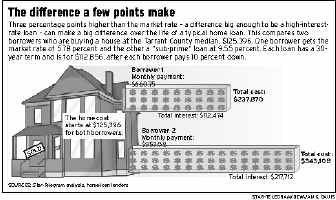

African-Americans and Hispanics who bought homes in North Texas last year were much more likely than Anglos and Asians to get mortgages with high interest rates. Federal data provided by the 20 largest mortgage lenders show that African-American borrowers in the Fort Worth-Arlington and Dallas metropolitan areas were more than four times more likely to get a high-rate mortgage than Anglo borrowers. Such loans carry an interest rate at least 3 percentage points higher than the market rate. Hispanics are nearly three times more likely to get such loans. The North Texas data track a national pattern, and the ethnic disparities persist across all income groups. Even African-American borrowers with more than $100,000 in household income get high-rate loans more frequently than Anglos earning less than $40,000. Borrowers' credit ratings were not considered in the analysis, because that information is private. In advance of the government's scheduled release of the data for all lenders on Monday, the Star-Telegram analyzed data for nearly 61,000 conventional home-purchase loans made in 2004 by the 20 largest lenders in North Texas. (See the box on page 8F for more on how these loans were chosen.) Data on loans from the nation's 25 largest mortgage lenders was analyzed by the Charlotte Observer, which like the Star-Telegram is owned by Knight Ridder. Together, those 25 lenders make about half of all such loans -- about 2 million in 2004. Since 1989, the federal Home Mortgage Disclosure Act has required mortgage lenders to report how often they deny loans to different ethnic groups. But this was the first year that federal regulators collected data on interest rates by ethnicity and income. Denial rates have shown similar ethnic disparities for many years. Last year, for example, African-American and Hispanic applicants in North Texas were turned down more than twice as often as Anglos. National figures are similar. Despite the differences, mortgage loans to ethnic minorities have grown sharply in the past decade. In 2004, African-Americans received twice as many home-purchase loans as in 1994. Some see that as progress."Twenty years ago, we were talking about redlining, that people weren't getting loans," said Paul Leonard of the Financial Services Roundtable in Washington, which represents large financial corporations. "Now we're having a legitimate discussion about whether people are getting the right price." But critics say the industry is simply discriminating in a new way. "Now what we have is reverse redlining," said Mal Maynard, director of the Financial Protection Law Center in Wilmington, N.C., which studies lending patterns. Lenders are targeting black neighborhoods for high-rate loans, he said. Not a coincidence Lenders say it's no coincidence that there are similar disparities in denial rates and high-interest loan rates for different ethnic groups. With the growth of automated underwriting systems to assess a person's financial background, and 15 years of government scrutiny, they say it's unlikely that the disparities are simply the result of discrimination. In their view, it's a societal issue. "What this says to me is the criteria that drove the denial disparities are the same that drive this issue" of high-rate loans, said David Fynn, senior vice president for regulatory risk at National City Corp. It's the nature of the loan, the customer's credit history and other objective measures like the borrower's income and value of the home, Fynn said. National City, based in Cleveland, is one of the nation's largest mortgage lenders and the fourth-largest in the Metroplex. It is relatively active in the high-rate market, with 12.4 percent of its loans in Dallas-Fort Worth qualifying as high rate. Although 9.2 percent of National City's Anglo borrowers got high-rate loans, 23 percent of African-Americans and 24.4 percent of Hispanics did. Once you consider the criteria National City uses to underwrite home loans, such as a borrower's credit rating, Fynn said, the ethnic differences shrink markedly. He declined to disclose precise figures, however, citing what he termed as liability risks. Steve Covington, director of quality control and compliance for First Horizon Home Loan Corp. in Irving, said his company has a similar experience. In Dallas-Fort Worth, 4.7 percent of First Horizon's more than 1,200 conventional purchase loans were classified as high-rate loans. The figure was 4.1 percent for Anglo borrowers and an unusually low 3.6 percent for Hispanics. But 25.6 percent of First Horizon's African-American borrowers in Dallas-Fort Worth got high-rate loans. That's more than a 500 percent difference between Anglos and African-Americans. Adjust the numbers for standard underwriting criteria, such as credit record, property value and down payment, Covington said, and that difference drops to 35 percent. His thinking on the larger disparity? "All you can say is that among the various ethnic groups, wealth is spread unequally," he said. "That's a problem in American society that needs work." 'A way to go forward' Keith Ernst, senior policy counsel at the Center for Responsible Lending in Durham, N.C., said the lenders have a point. Until the government collects the credit scores and other data that lenders use to make their decisions, the causes behind the disparities remain open to interpretation. The industry opposes such a collection, citing privacy grounds. But, Ernst said, the numbers are still valuable. "Does it prove discrimination beyond a shadow of a doubt? No one says it does," Ernst said. "But I don't think we need the perfect data set to have a good discussion about lending. It's a way to go forward." Federal studies of the lending industry, and federal lawsuits, have repeatedly focused on evidence of discrimination. In 2003, to mark the 35th anniversary of the Fair Housing Act, which made discrimination in lending illegal, President Bush pledged $50 million to fight ongoing abuses. He cited a 2002 study by the Department of Housing and Urban Development that showed that minorities get less information, less assistance and less-favorable terms from mortgage lenders. "Prejudice and discriminatory practices in housing still exist in America," Bush said. "These practices are wrong." With the emergence in the past decade of a thriving market for so-called "subprime" loans -- made to borrowers with less-than-sterling credit -- study is now moving beyond who is denied loans to who pays what rate. Subprime loans typically carry higher interest rates higher fees. The lending industry is bracing for the fallout from the release of the latest data. The Consumer Bankers Association's Fair Lending Conference in November has scheduled topics including "Modifying your fair lending program after HMDA" and how to deal with customer complaints. "Once the HMDA data is released, customers are going to be calling regarding the rates they have received," the program says. "How can your institution prepare for the deluge?" Income a small factor In the Metroplex, the percentage of high-rate loans, 9.4 percent, is somewhat higher than the national average of 8 percent. But when it comes to differences between ethnic groups, the local numbers track the national averages fairly closely. Asians are the least likely to get a high-rate loan in Dallas-Fort Worth, at 3.9 percent. They are followed by Anglos at 6.6 percent, Native Americans at 11.4 percent, Hispanics at 17.7 percent and African-Americans at 27 percent. The national figures are: Asians, 3 percent; Anglos, 6 percent; Native Americans, 10 percent; Hispanics, 14 percent; and African-Americans, 27 percent. A borrower's income did not explain the disparities, the Star-Telegram's analysis showed. At every income level, African-Americans and Hispanics got high-rate loans much more often than Anglos with similar income. As income rose, borrowers of all ethnicities were less likely to get high-rate loans. But as Anglo borrowers' income rose, their chances of getting a high-rate loan plunged from 11 percent for low-income Anglos to just 4 percent for high-income Anglos. Among African-American borrowers, the percentage of high-rate loans went from 36 percent for low-income borrowers to 18 percent for high-income borrowers. That means low-income African-Americans were more than three times as likely to get such loans than Anglos with similar incomes, but high-income African-American borrowers were 4 1/2 times as likely. And high-income African-American borrowers were more than 60 percent more likely to get high-rate loans than low-income Anglos. The loan records also suggest that borrowers' credit records are not the problem as often as lenders say. Credit history was cited less than a third of the time for all applicants who were denied loans and less than half the time for low-income African-American borrowers. Among high-income African-American borrowers denied loans, it was cited 28 percent of the time as the main reason, compared with 22 percent of the time for high-income Anglos. Automated underwriting One of the larger disparities in the prevalence of high-rate loans among Hispanics and African-Americans in the Metroplex was seen at two units of Regions Financial, a Birmingham, Ala.-based institution that also owns RegionsBank. Regions owns EquiFirst, a specialty subprime lender, and Union Planters, which merged with Regions last year, spokeswoman Kristi Ellis said.However, the Regions Financial lenders were relatively small in North Texas, writing just over 200 loans last year. That makes their numbers a less reliable measure of the company's record. What the numbers show is that 31 percent of Regions/EquiFirst borrowers who were Anglo got high-rate loans. African-Americans got high-rate loans 66.7 percent of the time, and Hispanics 71.4 percent of the time. Ellis said risk-related factors like creditworthiness and past payment history, not race, determine what a borrower pays for a mortgage. "If a borrower has a less than 'prime' creditworthiness, the risk taken to extend the loan is reflected in the pricing of that loan," she said. Lenders also say that over the past decade the industry has largely moved to automated underwriting, a computer-driven system that they say removes any biases an individual loan officer might hold. "Everything we do we run through an automated underwriting engine," said Brian Bennett, chief lending office at WR Starkey Mortgage of Plano, the No. 11 mortgage lender in Dallas-Fort Worth. Starkey does some lending to what Bennett described as relatively strong subprime borrowers, people who rate an A-minus or B-plus rather than a straight A on their credit records. If a borrower doesn't meet Starkey's standards, he said, the company refers the borrower to a specialized subprime lender. Bennett limits which subprime lenders Starkey deals with, he said, because not all treat their customers the same. "A lot of the public gets duped into seeing somebody post a great rate, and then it's like bait-and-switch," Bennett said. "Sometimes I get into a rate competition and I find out they're using somebody from Timbuktu." David Motley, executive vice president of Colonial National Mortgage in Fort Worth, made a similar point. "Real estate has attracted a lot of people in the last 10 years. They get in to make as much money as they can as fast as they can," he said, so "buyer beware applies" perhaps more than ever. "I'd be real skeptical of a third party with an interest in where that borrower goes," Motley said. Undisclosed deals Home builders, real-estate agents and mortgage brokers all can have various undisclosed relationships with lenders and one another, mortgage professionals say. Those relationships can easily result in parties working more for themselves than their customers. David O'Brien of Housing Opportunities of Fort Worth agreed. His organization counsels first-time and low-income home buyers. "It is not uncommon for them to name their Realtor as their loan officer," O'Brien said of his clients. "The Realtor has said, 'This is the place to get the loan.' It's more prevalent with people with credit problems and who are less sophisticated about the mortgage market." Hazel Muñoz, owner of A Casa Realtors in Fort Worth, said inexperience can leave a borrower open to abuses. "If you don't have a friend or family helping you, it makes it real easy for predatory lending," she said. The higher denial rates African-Americans experience also may play a role. Last year, the nation's 10 largest banking companies denied 8 percent of white applications and 21 percent of black applications. As a result, some blacks never ask a bank about a loan, said Louise Mack, who runs Prosperity Unlimited, a community-development group in Kannapolis, N.C. "People just feel like a bank is going to turn them down," Mack said. "You see this house and you want it right away, so you just go to whoever you think will give you the money." Independent brokers Often that means going to an independent mortgage broker who specializes in high-rate loans. These brokers sell two-thirds of high-rate loans. Brokers, who can help guide borrowers through a complex process, also play a less-understood role in determining the rate a borrower pays. They match borrowers with lenders for a fee, paid by the borrower, but brokers are not required to give their customers the lowest possible rate. Instead, they profit by quoting the borrower a higher interest rate than the lender has quoted. One Arlington broker said that if he can sell a borrower a loan with an interest rate 1 percentage point higher than what the lender originally quoted, he can earn a fee of 2 points. A point is 1 percent of the loan amount. On a $100,000 loan, that would earn him a quick $2,000. In 2002, the Department of Housing and Urban Development estimated that brokers overcharged customers by $3 billion a year. Colonial's Motley also said the common practice of selling mortgages also can cause problems. Most small lenders quickly sell their loans to investors and hand off the servicing to a loan servicer such as Colonial, which services about $7 billion worth of mortgages. Loan servicers handle the monthly payments, work out late payments when necessary and collect the escrow needed to pay annual property taxes and insurance premiums. "There are fewer and fewer of us who retain the servicing," Motley said. He believes that lenders who don't service loans "have less of an interest in the happiness and well-being of the borrowers. We have to face them every year." IN THE KNOW How to learn more Loan data for all mortgage lenders will be posted Monday by Federal Financial Institutions Examination Council at its Web site: www.ffiec.gov IN THE KNOW How the numbers were compiled To examine the prevalence of high-rate mortgages among different ethnic groups, the Star-Telegram collected data from the 20 largest mortgage lenders doing business in North Texas during 2004. This is the same data that lenders file with the federal government annually under the provisions of the Home Mortgage Disclosure Act. Among those top 20 lenders, the newspaper then focused on loans that most closely reflected the experiences of typical homebuyers. That narrowed the data down to nearly 61,000 loans that met the following criteria: A loan, not insured by any government program, that will be used for the purchase of a single-family residence that will be occupied by the owner. High-rate loans were identified using the federal definition of loans that carry an interest rate at least 3 percentage points above the comparable market interest rate.

Charts:

____________________________________________________________

- Jim Fuquay |

Home

Home  Mortgage Fraud News

Mortgage Fraud News  Ft Worth Star-Telegram - 1st in Series - Higher Mortgage Rates for Minorities

Ft Worth Star-Telegram - 1st in Series - Higher Mortgage Rates for Minorities  Home

Home  Mortgage Fraud News

Mortgage Fraud News  Ft Worth Star-Telegram - 1st in Series - Higher Mortgage Rates for Minorities

Ft Worth Star-Telegram - 1st in Series - Higher Mortgage Rates for Minorities