|

Homeowner horror

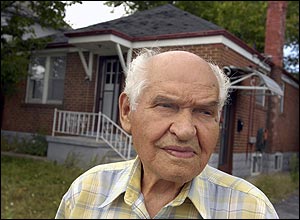

Paul Reviczky, who fled Hungary in 1957 to escape Communist persecution, is one of the latest homeowners to discover that Ontario law favours banks, mortgage companies and purchasers over victims of fraud

Toronto

Star

Homeowner horror

'My sense of security in

Canada

is gone' says Paul Reviczky, who learned about identity theft the hard way

Aug. 26, 2006

AROLD LEVY

An 89-year-old man has been left both heartbroken and betrayed after his

North York

bungalow was stolen from him in the rising wave of title fraud.

Paul Reviczky, 89, stands outside his house at 220 Sheppard Ave. W.

The property was sold out from under him in May, likely by “tenants†who

forged his name on a power of attorney. “I think he was targeted

because he is elderly,†his niece says.

Paul Reviczky, who fled

Hungary

in 1957 to escape Communist persecution, is one of the latest homeowners to discover that

Ontario

law favours banks, mortgage companies and purchasers over victims of fraud.

"I was shocked to learn that this could be the law in

Canada

," Reviczky says. "I fled

Hungary

to escape lawlessness like this and now my sense of security in

Canada

is gone."

Gerry Phillips,

Ontario

's minister of government services, vowed yesterday to change the land-registry system to protect homeowners like Reviczky from title fraud.

Reviczky purchased the property at 220 Sheppard Ave. W. in 1980 for $67,500 to generate a rental income that would help pay for the education of relatives back in Hungary.

The retired tobacco farmer, who came to Canada 49 years ago with his wife Ilona and his then 3-year-old daughter Marietta, says he felt so strongly about his duty to help out the family he left behind that he specified in his will that the property could not be sold after his death because the income was to be used for their support.

Since his wife's death in February 2005, he has lived alone in his home a few kilometres from the rental property.

Reviczky could not believe his ears on June 26 when his neighbour, a real estate agent, told him she had noticed on the computer that he had sold his rental property in May.

"So I went back to my office, got the record from the computer and showed it to him," Vivian Ho told the Toronto Star. "His face turned red and I was worried that he was going to have a heart attack."

Police believe Reviczky's most recent "tenants" forged his name on a power of attorney that purported to give a grandson named "Aaron Paul Reviczky" authority to sell the home on his behalf.

"I don't have a grandson named Aaron," Reviczky says. "I don't have any grandsons."

On May 15, "Aaron Paul Reviczky" sold the property on his behalf for $450,000 to a purchaser named Pegman Meleknia, who took out a mortgage of $337,500.

"I did not get the proceeds," Reviczky says.

Reviczky's lawyer, Tonu Toome, says it was "very painful" to have to break the news to Reviczky that he may lose his house forever — even though he was an innocent victim of fraud — because Ontario law recognizes the transaction as valid where the purchaser is unaware of the scam.

"I had to tell him that although he would ultimately receive financial compensation for the loss of his home, this would entail legal fees and an application to Ontario 's Land Titles Assurance Fund, which could take several years," Toome says.

Says Reviczky: "I want my home ... not just some money."

Phillips, who bears responsibility for the province's land titles registration system, says he met last week with 50 representatives of all the communities affected by title fraud — including police, real property and financial institutions — to get advice on how to stem this increasingly prevalent crime.

"This is a high priority for our government and I want people to know that we are treating it seriously," Phillips says.

Earlier this summer, several other identity-theft victims in Toronto were also shocked to discover they weren't protected by the law.

Susan Lawrence is a North York widow who faces the loss of the 100-year-old Victorian home she had lived in for 30 years — after criminals used publicly available information to sell her house without her knowledge and put a $300,000 mortgage on it.

Elizabeth Shepherd, an actress, lost her furnished Leslieville home to identity thieves, who rented the home and sold it to an accomplice after creating a false Elizabeth Shepherd. The accomplice took out a $250,000 mortgage, defaulted and disappeared.

Both women expect to spend years — and money they would rather not spend on lawyers — trying to sort out the mess.

Reviczky had put a "for rent" sign on his property on March 1 after the previous tenants who had lived there for 12 years had gone back to British Columbia.

Five days later, he agreed to rent the home to a couple who identified themselves as "Kristina and Adam Skurik." They signed rental papers and handed him $2,500 in $100 bills for first and last month's rent.

But the house remained empty. In mid-April, Reviczky says, he was told by Kristina Skurik that the couple had rented the house to someone who was coming from Russia.

The last time he ever saw either of the Skuriks was May 13, when Kristina gave him $1,250 in cash and told him the people would arrive "in a short time."

"Kristina was a very pretty, quiet girl, about 5 feet, 6 inches, and she appeared very likeable and trustworthy," Reviczky says.

A telephone check of listings throughout North America failed to turn up any Kristina or Adam Skurik.

Reviczky is now aware that he allegedly sold his house through the power of attorney that had been notarized by a North York lawyer named Sheldon Caplan, who said in an interview he is unable to discuss the case.

Reviczky says he was surprised to see at the bottom of the power of attorney — which Caplan notarized above what appears to be his scribbled initials — a notation that the document was "acknowledged before me this 18th day of April 2006 by Reviczky Paul, who is personally known to me of who has produced Drivers Licence."

"I have never retained solicitor Sheldon Caplan," Reviczky said in a statement he prepared for his lawyer. "I do not know him and did not communicate with him."

Toronto lawyer Satwant Singh Khosla, who represented the purchasers — parents who bought the property as an investment for their son — says his clients are "innocent buyers" who have suffered emotionally and financially because of the fraudulent transaction "through absolutely no fault of their own."

"It was a straightforward transaction," Khosla said. "We never realized that the power of attorney under which the property was transferred was fraudulent."

Khosla says his clients are on the hook for mortgage payments even though they have been unable to access the property because its legal status is in a state of flux.

Reviczky's daughter, Marietta Reviczky-Dolan, who lives in Montana , says people like her father should have the title returned to them and not left with the purchaser.

"They (the owners) have invested more than money in it," she says. "It is their past and their lives have been centred around it. It means more to them."

Meanwhile, the tiny house remains unoccupied and shows signs of disrepair, its yard often cluttered with garbage. It sits in a state of legal limbo while lawyers attempt to sort out the mess and the police hunt for the criminals and the $450,000 stolen along with Reviczky's heart.

Reviczky cannot even enter the home because that could technically be trespassing and police have told him that they will need consent from the new owners to enter the premises.

Toronto lawyer Sidney Troister, an expert on real estate and mortgage fraud, says the Reviczky case is perplexing because "while we can feel sorry for the first owner, we can feel equally sorry for the buyer, who like every other buyer could never be certain that their vendor is the real owner."

Troister says Ontario 's land titles system is a good system, "except in the event of fraud where it breaks down, and leaves innocent owners and innocent buyers and lenders helpless and without speedy and fair relief."

"Until the province can prevent this type of fraud from happening, it must formulate a more responsive and all-inclusive compensation scheme for title fraud," Troister says.

"Innocent people, whether it is the innocent owner or the innocent buyer or lender, get hurt because the province does not protect innocent people registering documents in the system."

Ralph Roberts, a Michigan-based expert on mortgage fraud, says inroads will not be made into burgeoning real property and mortgage fraud until more homeowners and legislators become aware it exists. "There is not enough of a public awareness," he says. "People just keep getting dragged into it one after another."

Last month, state legislators in Michigan declared war against mortgage and title fraud after FBI disclosures that mortgage fraud losses in the state jumped from almost $9 million in 2003 to $26 million in 2005.

Several bills introduced in July contain an arsenal of measures, such as designating millions of dollars for investigation of unlicensed real estate brokers and making mortgage fraud a serious crime punishable by 10 years in prison for a first offence.

Mortgage and title fraud have also taken on a higher profile in Canada recently.

Organizations such as the Law Society of Upper Canada have been meeting with their counterparts in the real estate and financial industries, and police authorities, to try and solve the problem.

Police forces in Greater Toronto are struggling to cope with a noticeable increase in complaints of title fraud. A report published in March 2005 by the law society says the fraud is often facilitated because the parties to the transaction may never know or actually meet each other in person.

"Without due diligence throughout the process, it is easy for fraudsters to pass themselves off and to take advantage of the lack of oversight," the report says.

"Mortgage fraud and other frauds relating to title are all on the rise," says Det. Steve Majoran of the Toronto force's fraud and forgery squad. "That's my overall impression."

Majoran advises people renting out their homes to check references and verify backgrounds "as best as you can," heeding gut feelings where an applicant puts you off, and to question offers of cash rent.

"You really have to do due diligence these days," he says.

Majoran, who cannot discuss individual cases, says title-fraud investigations can be challenging because they involve following a paper trail and tracking back through a scheme to try to determine who committed the crime, "often months after the fact."

"It's a total shock to the homeowner because the home has been stolen from under them without their knowledge — and usually without their complicity whatsoever," Majoran says.

"I found in a lot of title fraud cases that the person has worked all their life for a property and regards their home as their castle," he says. "To find it's been stolen right out from under them is totally devastating."

Gabriella Toth, who is Reviczky's niece, says she can't understand how anyone could steal an 89-year-old man's home.

"These have to be heartless persons," says Toth, a vice-principal at a Toronto high school. "I think he was targeted because he is elderly."

RELATED LINKS

Bob Aaron: Just change the law (July 29)

Province seeks to aid fraud victim (July 22)

Actress taken in by tenants (July 20)

Mortgage fraud victim to test law (July 6)

House title thieves can wreak havoc (April 22)

MPP calls for fraud check (April 14)

Man finds house was secretly sold (March 22)

Lawyer disbarred for role in mortgage scheme (Jan. 14)

With files from Associated Press

http://www.thestar.com/NASApp/cs/ContentServer?pagename=thestar/Layout/Article

_Type1&c=Article&cid=1156542610726&call_pageid=968332188774&col=968350116467 |

Home

Home  Mortgage Fraud News

Mortgage Fraud News  89-year-old Paul Reyicky home stolen in mortgage fraud scam

89-year-old Paul Reyicky home stolen in mortgage fraud scam  Home

Home  Mortgage Fraud News

Mortgage Fraud News  89-year-old Paul Reyicky home stolen in mortgage fraud scam

89-year-old Paul Reyicky home stolen in mortgage fraud scam