|

Arests expected soon in two other schemes based here

Eleven members of that 16-person ring -- which includes three real estate agents, an attorney, a mortgage broker and a former Wells Fargo bank officer -- are set to be sentenced today in U.S. District Court in Austin after being found guilty of wire fraud, money laundering and falsifying information on loan documents as part of this scam that hit Austin and that San Antonio neighborhood...Texas is among the top 10 states for mortgage abuses, and San Antonio is involved in three such scams so far this year, the Austin case and two San Antonio-based rings under investigation by the Federal Bureau of Investigation. The San Antonio rings used more than 50 people to inflate prices in Stone Oak, Spring Branch and Dallas. FBI special agents investigating the cases have said that arrests would happen soon this summer.

11 face justice today in mortgage fraud

Arests expected soon in two other schemes based here

06/05/2008

By Aïssatou Sidimé

This e-mail address is being protected from spam bots, you need JavaScript enabled to view it

On a one-block street in Northwest San Antonio, five properties all fell into foreclosure in 2003. When federal investigators began poking around, they tied the properties on Meadow Field near Grissom Road to an Austin-based house-flipping ring.

Eleven members of that 16-person ring -- which includes three real estate agents, an attorney, a mortgage broker and a former Wells Fargo bank officer -- are set to be sentenced today in U.S. District Court in Austin after being found guilty of wire fraud, money laundering and falsifying information on loan documents as part of this scam that hit Austin and that San Antonio neighborhood.

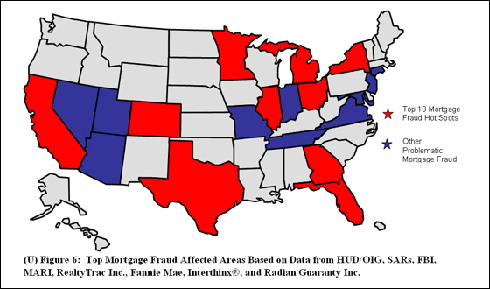

Top 10 States for Mortgage Fraud (Source FBI)

California, Collorado, Florida, Georgia, Illinois,

Michigan, Minnesota, New York, Ohio, Texas

The Austin ring is part of a swelling wave of mortgage fraud that isn't expected to crest until late next year.

Texas is among the top 10 states for mortgage abuses, and San Antonio is involved in three such scams so far this year, the Austin case and two San Antonio-based rings under investigation by the Federal Bureau of Investigation. The San Antonio rings used more than 50 people to inflate prices in Stone Oak, Spring Branch and Dallas.

FBI special agents investigating the cases have said that arrests would happen soon this summer.

“Typically what happens is incidents are not identified until months after the loans were originated, so many (federal) agencies are just closing cases from 2000 and 2001,†said Tom Chmielewski, vice president of products and strategy at ChoicePoint which owns the Mortgage Asset Research Institute. “I expect the fraud to be at elevated levels for the next couple of years.â€

The increased fraud activity has its roots in the housing boom and the popularity of no-documentation loans -- loans where information entered about the background and finances of buyers were not verified.

“A lot of it popped up in the last four to five years particularly with no-doc, low-doc loans because nobody was verifying anything,†said Jim Gaines, a research economist at the Real Estate Center at Texas A&M University.

Nationwide, financial institutions reported 46,717 cases of suspicious activity in mortgage lending in fiscal 2007, according to the FBI. That's a 31 percent increase from fiscal 2006, when lenders began to loosen lending guidelines, and a 574 percent increase since fiscal 2003, when the housing boom started to take off.

Most of the cases are in Texas, California, Colorado, Florida, Georgia, Illinois, Michigan, Minnesota, New York and Ohio, according to the FBI's 2008 mortgage fraud report. One study by mortgage insurer Radian Group found that 10.5 percent of all mortgages it had insured in Texas in 2007 showed signs of “misrepresentation,†according to Rick Gillespie, Radian senior vice president.

The cases typically feature an appraiser who agrees to provide inflated appraisals for a kickback, and “straw buyers†-- people who rent out their personal information to another person for the purchase of a house with the understanding that home will be sold in a quick flip to another buyer after a few months.

According to the indictment in the case of the Austin-based fraud ring, Austin resident Cornelius Robinson created a company named Billionaires Boys Club Investments Inc. (BBC) and then recruited his wife and former real estate agent Silvia Seelig, Austin lawyer George H. Watson, former Wells Fargo personal banker Doris Ann Hill, and Robinson's uncle and friends to help buy 25 properties using fraudulent practices.

The team falsified addresses and telephone numbers for straw buyers, as well as rental histories, employment histories and bank deposits, according to the indictment.

In San Antonio, BBC bought five fourplexes on Meadow Field on Aug. 14, 2001, for $100,000 each and then sold them during the same month to an “unindicted co-conspirator†for $157,000 each.

The second buyer sold four of the properties about eight months later to another “unindicted co-conspirator†for $167,000. At some point, the mortgage payments no longer were being paid and lenders foreclosed on all five properties in 2003, according to the court record.

When so many foreclosures happen close together, it can hurt home prices.

Within San Antonio's Great Northwest area, where the Meadow Field properties are located, the median price dropped 2.4 percent in 2004, the year after the five properties were foreclosed, according to the San Antonio Board of Realtors.

In January 2008, 16 people were indicted for having participated in BBC's mortgage scams. Seelig, Watson, Hill and eight other defendants pleaded guilty to charges related to wire fraud, money laundering and making false statements on loans and will be sentenced today.

Robinson went to trial and was convicted of five counts of wire fraud, seven counts of money laundering and nine counts of making false statements on loans, according to the U.S. Attorney's Office. His case is set for sentencing on June 20.

In the two ongoing local investigations, FBI special agent David Rawlings who is leading the investigation, says 54 people committed mortgage fraud to buy 112 houses in Stone Oak, Spring Branch and Dallas.

Because the investigation is ongoing, Rawlings would not give many details about the cases.

But he did say that in some instances, the straw buyers bought and flipped homes with the help of two San Antonio-based mortgage brokers. In other cases, a buyer purchased a new home at a discount, but got the builder to falsify the mortgage documents by saying the house was sold for a higher price than it was. After the inflated loan closed, the buyer paid the builder a kickback.

Rawlings explained that in San Antonio, several of the cases involved new construction. San Antonio overbuilt homes in 2006 and 2007, and for the past two years, builders have started fewer houses in an effort to sell off their existing inventory.

Such scenarios can create a climate ripe for fraud, Rawlings said.

“Where there's newer construction, you have a lot of desperate sellers and builders,†Rawlings said. “The losses have been up to $400,000 and $500,000 on some million-dollar homes.â€

Such fraud techniques are not exclusive to Texas.

One of the largest publicized cases this year happened in Chicago, where lenders lost an estimated $25 million on more than 150 properties after loan officers, processors, a CPA, a real estate agent and developers falsified employment, assets and rental history for straw buyers.

Real estate and foreclosure experts say the frenzy of the housing boom created the atmosphere where such widespread fraud could flourish.

The fraud mushroomed as lenders faced rising pressure to increase sales.

“I've talked with loan officers who routinely said they'd deny a loan and their bosses would come back and say, ‘Approve it,'†said Rick Sharga, vice president of marketing at RealtyTrac Inc. that monitors foreclosure activity. “When the loan officer said, ‘The loan doesn't fit our lending standards,' (then) the supervisor would say, ‘That's OK. Somebody will buy it.'â€

News Researcher Julie Domel contributed to this report.

http://www.mysanantonio.com/business/stories/MYSA060608_01C_MortgageFraud060608.3372557.html |

Home

Home  Mortgage Fraud News

Mortgage Fraud News  11 face justice today in mortgage fraud

11 face justice today in mortgage fraud  Home

Home  Mortgage Fraud News

Mortgage Fraud News  11 face justice today in mortgage fraud

11 face justice today in mortgage fraud