|

Home Builders' Stock Sales: Diversifying or Bailing Out?

Shedding Shares

Now they are cashing in. Executives and directors at many of the nation's largest development companies sold stock at a record pace this summer. Insiders at the 10 largest home builders by market value, including D. R. Horton, KB Home, Toll Brothers and M.D.C. Holdings, have sold nearly 11 million shares, worth $952 million, so far this year. That is a huge jump from the 6.8 million shares, worth $658 million, that insiders sold during all of last year, according to data compiled by Thomson Financial. Market specialists often view heavy stock sales by corporate insiders as a possible indicator that share prices are headed lower. Some analysts say that the share sales by home builders are reminiscent of the heavy dumping of stock by technology company executives just before the technology bubble burst in 2000. See related article 8/7/05: KB Home Stock Down $10.95 – Foreclosures are up - FTC & HUD’s Flood of Complaints Prompts Investigations

Home Builders' Stock Sales: Diversifying or Bailing Out? Home Builders' Stock Sales: Diversifying or Bailing Out?By JULIE CRESWELL Published: October 4, 2005

Home builders have never had it so good. Low interest rates and creative financing have caused a frenetic pace of new-home construction across the country. Builders are reporting blistering earnings and their shares are trading at or near record highs.

Enlarge This Image

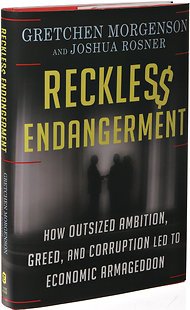

Bob Shanley/Palm Beach Post - A builder recently paid $70 million for Casa Apava in Palm Beach, Fla.

Building Fortunes

Cashing In

Articles in this occasional series will profile a variety of businesspeople who have grown wealthy from the real estate boom.

List of Top 100 Selling Insiders at Homebuilding Companies (Excel format) Market specialists often view heavy stock sales by corporate insiders as a possible indicator that share prices are headed lower. Some analysts say that the share sales by home builders are reminiscent of the heavy dumping of stock by technology company executives just before the technology bubble burst in 2000. For that reason, the staggering level of insider sales has analysts and investors wondering if home builders see something menacing on the horizon, like a cooling of the real estate market. Home builders say the stock sales are not a signal that they believe the property boom is waning. Instead, most executives said that they were selling because they needed to diversify their personal wealth. Some outsiders are not so sure. "The previous times we've had insider selling that was that high, it was followed by a 20 percent decline in the index of home builder stocks," said Mark A. LoPresti, senior quantitative analyst with Thomson Financial. Since its July 28 peak, the Philadelphia Stock Exchange Housing Sector Index, an index of 21 home building stocks, has dipped 10 percent. Among those cashing in some chips is Zvi Barzilay, the president and chief operating officer of Toll Brothers, based in Horsham, Pa. He sold 460,400 shares worth more than $39 million, the bulk of it in June and July. That was more than four times the 150,000 shares, worth nearly $8.7 million, that Mr. Barzilay sold last year. Likewise, David D. Mandarich, the president and chief operating officer of M.D.C. Holdings, sold 285,499 shares, worth nearly $25 million, in three days in July, compared with the 192,115 shares, worth $13.8 million, he sold in all of 2004. M.D.C. Holdings is based in Denver. Not all executives are taking profits at the same rate. Stock sales at Pulte Homes and NVR, the nation's second-largest and seventh-largest home building companies, are down from last year's levels. Still, Dwight C. Schar, the chairman of NVR, who sold $155 million worth of stock last year, tops the list of insider sales so far this year. In eight days in May, Mr. Schar sold $88.4 million worth of stock in NVR, based in Reston, Va. Mr. Schar's fortunes have changed significantly from 1992, when NVR was forced to file for bankruptcy protection. Last year, he drew a lot attention when he purchased a seven-bedroom, 18-bathroom oceanfront house in Palm Beach, Fla., called Casa Apava, and an adjacent property for a reported $70 million. The seller was Ronald O. Perelman, the Revlon chairman. Mr. Schar, 63, who would not comment for this article, also owns a stake in the Washington Redskins football team and runs with Washington's political elite as the Republican National Committee finance chairman. President Bush often singles him out in speeches to thank him for his fund-raising prowess. The heavy stock sales are occurring at a time when housing-related data remain decidedly mixed, confusing home buyers and sellers alike. While recent data showed that sales of existing homes were near record highs, another government report last week said the supply of unsold homes in August rose to its highest level in five years, and some analysts said that could begin to put pressure on home prices. The Commerce Department also reported that sales of new single-family homes fell 9.9 percent in August, dropping nearly 18 percent in the western United States, including Southern California, Phoenix and Las Vegas, where new-home markets have been particularly hot. Furthermore, a survey of home builder optimism taken in early September fell to its lowest level in two years. "If you watch the C.E.O.'s of the big home building companies on CNBC, the word is, 'onward and upward,' " said David F. Seiders, chief economist at the National Association of Home Builders. "But a number of forecasters, including myself, keep insisting that the market is going to lose some momentum next year." Home builders denied that heavy insider sales were a sign that they had lost confidence. "We're still anticipating record earnings for 2005 and 2006," said Paris G. Reece III, the chief financial officer of M.D.C. Holdings; he has sold more than $11 million in stock this year, double what he sold last year. Mr. Reece attributed his own stock sales - as well as those of Mr. Mandarich and other M.D.C. executives - to options that were expiring in November. In total, insiders at M.D.C. have sold $71 million in stock, up from $48 million last year. The Ryland Group said the sales of 260,000 shares worth $17.7 million sold by its chief executive, R. Chad Dreier, took place on a predetermined schedule that has existed for the last five years. Executives at Hovnanian Enterprises, the Lennar Corporation and elsewhere said they were merely diversifying their portfolios after the huge surge in the market value of their shares in recent years tied more and more of their personal wealth to the company. "The stock sales have nothing to do with the state of the market. It has everything to do with diversification," said Joel H. Rassman, the chief financial officer of Toll Brothers, who has sold 105,000 shares worth $8.1 million. That is almost double the 60,600 shares he sold last year for about $4 million. In fact, insiders at Toll Brothers, which announced in September that it would sponsor live radio broadcasts of the New York Metropolitan Opera, have been among the most active sellers of stock this year. They have sold nearly six million shares, worth more than $468 million, so far in 2005. That is three times the number of shares that netted Toll insiders $158 million last year. Robert I. Toll, the chief executive of Toll Brothers and an avid art collector, has sold for some $20 million about 200,000 shares that he held directly, up from 120,000 shares last year that were worth $7.7 million. (Mr. Toll has also sold another $244 million in stock this year that he held indirectly for charitable foundations and in trusts for his five children.) "Even after all of the sales that have taken place, Bob Toll still owns about $1.2 billion, plus or minus, in company stock and options," Mr. Rassman said. "Any investment adviser would tell Bob Toll that he should be diversifying to an even greater extent than he is." Likewise, the $28 million in stock sales in July by Jeffrey T. Mezger, the chief operating officer of KB Home, is the first stock sale in the 12 years he has been with the company, KB Home said in a statement. The "vast majority of his net worth" is still invested in the company's stock, the company said. "KBH stock has appreciated 600 percent over the past five years, and it is widely considered a prudent investment strategy to diversify one's net worth," it added. Furthermore, KB Home, based in Los Angeles, noted that it recently reported record earnings and that it had raised earnings guidance for every year through 2008. "With a current sales backlog of over $7 billion, the company's outlook is extremely positive," the statement concluded. But if the market is so great and if, as most home builders argue, their stocks are undervalued, why are executives selling now? asked Richard Bernstein, chief United States strategist at Merrill Lynch. Mr. Bernstein issued a report in late August saying that insider sales at home builders mimicked what happened in the technology sector before those stocks peaked in 2000. "People say these companies are closely held and that the executives are trying to diversify, but why now?" asked Mr. Bernstein, adding that similar sales levels were not apparent in other top-performing industries this year. "They could have diversified their holdings 2, 5 or even 10 years ago." Home builders respond by saying that the need to diversify took on a greater sense of urgency after the huge leaps in their stock prices in the last year. "Our stock price has essentially doubled since a year ago, from $23 to around $44" on a split-adjusted basis, said Mr. Rassman of Toll Brothers. "Like other home building companies, we highly compensate our employees and senior employees with stock. As the stocks have done well, they have become a larger and larger percentage of our wealth." Another reason for the sales may be that after living through the last boom-and-bust housing cycle a decade ago, few home building executives want to return to the days when they watched their fortunes quickly disappear, analysts said. In the early 1990's, most home builders were on the verge of collapse as interest rates rose sharply and some of their business practices, like building homes on a speculative basis, hoping buyers would emerge, left them with plenty of homes that they could not sell. Home builders who survived the last housing cycle insist they have learned their lessons and that even if a slowdown occurs, they will not be hurt as much. For instance, many home builders today hold options to buy land rather than own the land outright. Also, most will not start to lay the foundation of a home until they have a signed contract. Just as they may have tried to insulate their businesses from any real estate downturns, many executives could simply be trying to protect their personal wealth as well by selling some stock, analysts said. "These are record times for the industry, and there's not much chance it's going to get a whole lot better," said Gregory E. Gieber, a home builder analyst with A. G. Edwards. "These guys know that the good times don't last forever, and they've been out there in the cold before."

Top 100 Selling Insiders

http://www.nytimes.com/2005/10/04/business/04builders.html

|