|

Banks vs. Consumers (Guess Who Wins)

The National Arbitration Forum (NAF), a for-profit company based in Minneapolis, specializes in resolving claims by banks, credit-card companies, and major retailers that contend consumers owe them money. Often without knowing it, individuals agree in the fine print of their credit-card applications to arbitrate any disputes over bills rather than have the cases go to court. What consumers also don't know is that NAF, which dominates credit-card arbitration, operates a system in which it is exceedingly difficult for individuals to prevail.

Banks vs. Consumers (Guess Who Wins)

The business of resolving credit-card disputes is booming. But critics say the dominant firm favors creditors that are trying to collect from unsophisticated debtors

by Robert Berner and Brian Grow

Illustration by Matt Mahurin

What if a judge solicited cases from big corporations by offering them a business-friendly venue in which to pursue consumers who are behind on their bills? What if the judge tried to make this pitch more appealing by teaming up with the corporations' outside lawyers? And what if the same corporations helped pay the judge's salary?

It would, of course, amount to a conflict of interest and cast doubt on the fairness of proceedings before the judge.

Yet that's essentially how one of the country's largest private arbitration firms operates. The National Arbitration Forum (NAF), a for-profit company based in Minneapolis, specializes in resolving claims by banks, credit-card companies, and major retailers that contend consumers owe them money. Often without knowing it, individuals agree in the fine print of their credit-card applications to arbitrate any disputes over bills rather than have the cases go to court. What consumers also don't know is that NAF, which dominates credit-card arbitration, operates a system in which it is exceedingly difficult for individuals to prevail.

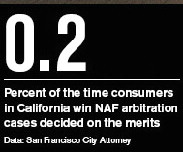

Some current and former NAF arbitrators say they make decisions in haste—sometimes in just a few minutes—based on scant information and rarely with debtor participation. Consumers who have been through the process complain that NAF spews baffling paperwork and fails to provide the hearings that it promises. Corporations seldom lose. In California, the one state where arbitration results are made public, creditors win 99.8% of the time in NAF cases that are decided by arbitrators on the merits, according to a lawsuit filed by the San Francisco city attorney against NAF.

"NAF is nothing more than an arm of the collection industry hiding behind a veneer of impartiality," says Richard Neely, a former justice of the West Virginia supreme court who as part of his private practice arbitrated several cases for NAF in 2004 and 2005.

A DIFFERENT REALITY

NAF presents its service in print and online advertising as quicker and less expensive than litigation but every bit as unbiased. Its Web site promotes "a fair, efficient, and effective system for the resolution of commercial and civil disputes in America and worldwide."

But internal NAF documents and interviews with people familiar with the firm reveal a different reality. Behind closed doors, NAF sells itself to lenders as an effective tool for collecting debts. The point of these pitches is to persuade the companies to use the firm to resolve clashes over delinquent accounts. JPMorgan Chase (JPM) and Bank of America (BAC) are among the large institutions that do so. A September, 2007, NAF PowerPoint presentation aimed at creditors and labeled "confidential" promises "marked increase in recovery rates over existing collection methods." At times, NAF does this kind of marketing with the aid of law firms representing the very creditors it's trying to sign up as clients.

NAF, which is privately held, employs about 1,700 freelance arbitrators—mostly moonlighting lawyers and retired judges—who handle some 200,000 cases a year, most of them concerning consumer debt. Millions of credit-card accounts mandate the use of arbitration by NAF or one of its rivals. NAF also resolves disputes involving Internet domain names, auto insurance, and other matters. In 2006 it had net income of $10 million, a robust margin of 26% on revenue of $39 million, according to company documents.

NAF's success is part of a broader boom in arbitration dating back to the 1980s, when companies began introducing language into employment contracts requiring that disputes with workers be resolved out of court. Mandatory arbitration spread to other kinds of agreements, including those involving credit cards.

NUMEROUS LOYAL PATRONS

Now, with the economy stumbling, NAF's focus on consumer credit could prove even more lucrative. U.S. credit-card debt hit a record high of $957 billion in the first quarter of 2008, up 8% from the previous year, according to Federal Reserve data. People who had relied on home-equity loans are seeing that money evaporate in the mortgage crisis and are running up card balances. Card providers, meanwhile, are increasingly turning to arbitration to collect on delinquent accounts.

Even consumer advocates concede that most people accused of falling behind do owe money. But the amounts are often in dispute because of shifting interest rates, fees, and penalties. Sometimes billing mistakes or identity fraud lead to confusion. Plenty of acrimony surrounds the traditional collections process in which lenders' representatives or companies that buy debt at a discount pressure consumers to pay up. Arbitration is supposed to be different. Endorsed by federal law, it purports to offer something akin to the evenhanded justice of the court system. That's why state and federal judges overwhelmingly uphold arbitration awards challenged in their courtrooms. This confidence may be misplaced, however, at least in many cases that come before NAF. (Its main competitors—the nonprofit American Arbitration Assn. in New York and JAMS, a for-profit firm in Irvine, Calif.—tend to attract employment disputes and contractual fights between companies.)

NAF has numerous loyal patrons among the country's financial titans. Chase says in a statement that it "uses NAF almost exclusively in its collection-arbitration proceedings due to NAF's lower cost structure." Companies pay from $50 to several hundred dollars a case, depending on its complexity. "Many legal commentators have found arbitration to be fair, efficient, more consumer friendly, and faster than the court system," Chase adds. Roger Haydock, NAF's managing director, says: "This is like the Field of Dreams: Build a ballpark, and they will come."

Others argue that NAF umpires make calls that put debtors at a disadvantage. In March, Dennis J. Herrera, San Francisco's city attorney, sued the firm in California state court, accusing it of churning out awards for creditors without sufficient justification. The lawsuit cites state records showing that NAF handled 33,933 collection arbitrations in California from January, 2003, through March, 2007. Of the 18,075 that weren't dropped by creditors, otherwise dismissed, or settled, consumers won just 30, or 0.2%, the suit alleges. "NAF has done an end run around the law to strip consumers of their right to a fair collection process," Herrera says in an interview.

The firm counters in court papers that federal law intended to encourage arbitration precludes the suit. NAF's "neutral decision-makers constitute a system that satisfies or exceeds objective standards of fairness," the firm says in a press release. NAF adds in an e-mail that the suit obscures thousands of cases in which consumers prevail because creditors abandon their claims or the disputes are "otherwise terminated."

So far, the San Francisco litigation relies mostly on publicly available information about NAF. Internal documents and interviews provide a more detailed picture of the firm.

The September, 2007, marketing presentation, which NAF left with a prospective customer, boasts that creditors may request procedural maneuvers that can tilt arbitration in their favor. "Stays and dismissals of action requests available without fee when requested by Claimant—allows Claimant to control process and timeline," the talking points state.

A current NAF arbitrator speaking on condition of anonymity explains that the presentation reflects the firm's effort to attract companies, or "claimants," by pointing out that they can use delays and dismissals to manipulate arbitration cases. "It allows the [creditor] to file an action even if they are not prepared," the arbitrator says. "There doesn't have to be much due diligence put into the complaint. If there is no response [from the debtor], you're golden. If you get a problematic [debtor], then you can request a stay or dismissal." When some creditors fear an arbitrator isn't sympathetic, they drop the case and refile it, hoping to get one they like better, the arbitrator says.

The firm goes out of its way to tell creditors they probably won't have to tussle with debtors in arbitration. The September, 2007, NAF presentation informs companies that in cases in which an award or order is granted, 93.7% are decided without consumers ever responding. Only 0.3% of consumers ask for a hearing; 6% participate by mail.

NAF says in a statement that it legitimately markets its services. As for the evenhandedness of the process, it adds: "Arbitration procedures are quite flexible and make stays and adjournments available to both claimants and respondents."

Many arbitrators praise NAF. In response to BusinessWeek's (MHP) inquiries, the firm sent an e-mail to a group of arbitrators asking for statements "demonstrating that you provide an invaluable service to the public by acting as a fair, independent, and unbiased Neutral." NAF passed along 10 testimonials. In one, Michael Doland, an arbitrator and attorney in Los Angeles, says: "The cynical view that arbitrators favor businesses over consumers is not correct with regards to the NAF. No communication, direct or indirect, from the NAF to myself as an arbitrator ever suggested such an approach." In an interview, Doland says: "If I ever thought this process was corrupt, that would be the day, the hour, that I would resign."

But other arbitrators have quit NAF for just that reason. Elizabeth Bartholet, a Harvard Law School professor and advocate for the poor, worked as an NAF arbitrator in 2003 and 2004 but resigned after handling 24 cases. NAF ran "an unfair, biased process," she said in a deposition in September, 2006, in an Illinois state court lawsuit. NAF isn't named as a defendant in the pending case, which challenges a computer maker's use of an NAF arbitration clause. Bartholet said that after she awarded a consumer $48,000 in damages in a collections case, the firm removed her from 11 other cases. "NAF ran a process that systematically serviced the interests of credit-card companies," she says in an interview.

In response, the firm says that both sides in each case have the right to object to one arbitrator suggested by NAF, based on the arbitrator's professional biography, which is provided to the parties. Creditors had simply exercised that option with the Harvard professor, NAF says.

SWIFT DECISIONS

Even arbitrators who speak highly of NAF say that the decision-making process often takes very little time. Anita Shapiro, a former Los Angeles superior court judge, says she has handled thousands of cases for the company over the past seven years. Creditors' lawyers have always assured her that consumers are informed by mail when they are targeted in arbitration, as NAF rules require, she says. But in the majority of cases consumers don't respond. She assumes this is the consumers' choice. Shapiro says she usually takes only "four to five minutes per arbitration" and completes "10 to 12 an hour." She is paid $300 an hour by NAF. If she worked more slowly, she suspects the company would assign her fewer cases.

Asked about Shapiro's account, NAF says: "Arbiters alone determine the amount of time required to make their decisions." It adds that collections cases tried in court are often decided swiftly when consumers don't respond. NAF says its "arbitrators provide much greater access to justice for nonappearing consumer parties by ensuring that the [corporate] claimant submits sufficient evidence."

But some consumers, including those on whose behalf the city of San Francisco is suing, complain that they don't have a real opportunity to contest NAF arbitration cases. By design, arbitration rules are less formal than those of lawsuits. The target of an arbitration can be informed by mail rather than being served papers in person. Evidence can be introduced without authentication.

The firm goes out of its way to tell creditors they probably won't have to tussle with debtors in arbitration. The September, 2007, NAF presentation informs companies that in cases in which an award or order is granted, 93.7% are decided without consumers ever responding. Only 0.3% of consumers ask for a hearing; 6% participate by mail.

NAF says in a statement that it legitimately markets its services. As for the evenhandedness of the process, it adds: "Arbitration procedures are quite flexible and make stays and adjournments available to both claimants and respondents."

Many arbitrators praise NAF. In response to BusinessWeek's (MHP) inquiries, the firm sent an e-mail to a group of arbitrators asking for statements "demonstrating that you provide an invaluable service to the public by acting as a fair, independent, and unbiased Neutral." NAF passed along 10 testimonials. In one, Michael Doland, an arbitrator and attorney in Los Angeles, says: "The cynical view that arbitrators favor businesses over consumers is not correct with regards to the NAF. No communication, direct or indirect, from the NAF to myself as an arbitrator ever suggested such an approach." In an interview, Doland says: "If I ever thought this process was corrupt, that would be the day, the hour, that I would resign."

But other arbitrators have quit NAF for just that reason. Elizabeth Bartholet, a Harvard Law School professor and advocate for the poor, worked as an NAF arbitrator in 2003 and 2004 but resigned after handling 24 cases. NAF ran "an unfair, biased process," she said in a deposition in September, 2006, in an Illinois state court lawsuit. NAF isn't named as a defendant in the pending case, which challenges a computer maker's use of an NAF arbitration clause. Bartholet said that after she awarded a consumer $48,000 in damages in a collections case, the firm removed her from 11 other cases. "NAF ran a process that systematically serviced the interests of credit-card companies," she says in an interview.

In response, the firm says that both sides in each case have the right to object to one arbitrator suggested by NAF, based on the arbitrator's professional biography, which is provided to the parties. Creditors had simply exercised that option with the Harvard professor, NAF says.

SWIFT DECISIONS

Even arbitrators who speak highly of NAF say that the decision-making process often takes very little time. Anita Shapiro, a former Los Angeles superior court judge, says she has handled thousands of cases for the company over the past seven years. Creditors' lawyers have always assured her that consumers are informed by mail when they are targeted in arbitration, as NAF rules require, she says. But in the majority of cases consumers don't respond. She assumes this is the consumers' choice. Shapiro says she usually takes only "four to five minutes per arbitration" and completes "10 to 12 an hour." She is paid $300 an hour by NAF. If she worked more slowly, she suspects the company would assign her fewer cases.

Asked about Shapiro's account, NAF says: "Arbiters alone determine the amount of time required to make their decisions." It adds that collections cases tried in court are often decided swiftly when consumers don't respond. NAF says its "arbitrators provide much greater access to justice for nonappearing consumer parties by ensuring that the [corporate] claimant submits sufficient evidence."

But some consumers, including those on whose behalf the city of San Francisco is suing, complain that they don't have a real opportunity to contest NAF arbitration cases. By design, arbitration rules are less formal than those of lawsuits. The target of an arbitration can be informed by mail rather than being served papers in person. Evidence can be introduced without authentication.

In March the law firm Wolpoff & Abramson settled a class action in federal court in Richmond, Va., alleging unfairness by the firm in NAF arbitrations. The suit, filed on behalf of 1,400 Virginia residents pursued by the credit-card giant MBNA, claimed that Wolpoff & Abramson, which represented the company, promised them in writing that they could appear at hearings before an NAF arbitrator but then failed to arrange for the hearings. NAF wasn't named as a defendant in the suit. Denying wrongdoing, Wolpoff & Abramson agreed to pay a total of $60,000 in damages. The firm, based in Rockville, Md., declines to comment. NAF denies that consumers were falsely promised hearings.

TROUBLING FORMS

Diane McIntyre, a 52-year-old legal assistant and one of two lead plaintiffs in the Virginia class action, says she was gradually paying down $9,000 she owed MBNA. She had reduced her debt to about $6,000 when she got word in May, 2005, from Wolpoff & Abramson of an arbitration award against her for $6,519, plus $977 in legal fees. She intended to contest the amount of the award and the fees at a hearing but never had a chance. "I wanted to pay the debt" but not all at once, she explains. As part of the class action settlement, Wolpoff & Abramson agreed to accept $4,000 from McIntyre.

A number of other NAF arbitratorsBusinessWeek contacted independently say that even apart from the absence of debtors contesting most cases, NAF's procedures tend to favor creditors. What most troubled Neely, the former West Virginia supreme court justice, was that NAF provided him with an award form with the amount sought by the creditor already filled in. This encourages the arbitrator to "give creditors everything they wanted without having to think about it," says Neely.

In the three NAF cases he decided, Neely says he granted the credit-card companies the balances and interest they claimed but denied them administrative fees, which totaled about $300 per case. Neely says such fees wouldn't be available to creditors who filed suit in court. "It's a system set up to squeeze small sums of money out of desperately poor people," he asserts. Neely stopped receiving NAF assignments in 2006 after he published an article in a legal publication accusing the firm of favoring creditors.

NAF says that Neely's accusations lack "any shred of truth." The independence of its arbitrators ensures they will decide cases diligently, NAF adds. "Arbitrators are in no way discouraged from deviating from the [creditor's] requested relief."

Lewis Maltby, a lawyer in Princeton, N.J., decided six credit-card cases for NAF in 2005 and 2006 but says he stopped because, like Neely, he became "uncomfortable" with the process. Maltby runs a nonprofit group promoting employee rights and has served as a director of the American Arbitration Assn. (AAA). Working for NAF, he was surprised at how little information he received to make his decisions. Files contained printouts purporting to summarize a consumer's debt and an unsigned, generic arbitration agreement, he says. "If you wanted free money, you could do [each case] in five minutes."

Maltby says the most difficult cases to decide were three claims by MBNA to which consumers did not respond. The files lacked any evidence that the consumer had been notified, he says. He ruled in MBNA's favor, having assumed that the debts were "probably" genuine. But he adds: "I would have liked to have been more confident that was the case." He did slice the fees requested by creditors' lawyers, because he thought they had expended little effort. He decided one other case for MBNA after the debtor conceded in writing that he owed money but couldn't afford to pay. MBNA withdrew another claim after the consumer said he had been the victim of identity theft, Maltby says.

In a statement, NAF says that BusinessWeek misrepresented Maltby's views. But Maltby later said he stands by all his comments. In a statement, Bank of America, which acquired MBNA in January, 2006, declines to comment because of the suit filed by San Francisco against NAF.

William A. Gould Jr., a Sacramento lawyer with a general private practice, says he stopped handling arbitrations for the company after doing several in 2003 and 2004 because the process "just seemed to be pretty one-sided." He says he didn't observe specific instances of bias but became concerned about the imbalance between creditors and their law firms—which were highly sophisticated about NAF procedures—and most consumers, who were naive and lacked legal representation. "The whole organizational mechanism was set up to effect collections," Gould says. Asked to respond, NAF says creditors and their attorneys are "no more sophisticated" about arbitration than they are about court procedures, and consumers are "no more naive."

Founded in 1986, NAF at first depended heavily on one customer, ITT Consumer Financial, the now-defunct lending arm of conglomerate ITT. (ITT) Milton Schober, then the general counsel of ITT Consumer Financial, says he opposed the relationship, fearing it could deny individuals the broader rights they enjoyed in court, such as greater latitude to appeal. Top officials of ITT Consumer Financial, which like NAF was based in Minneapolis, felt otherwise. "Management thought [NAF's] rules for arbitration favored creditors more," says Schober, who is now retired. "Shopping for justice: That's what it was." Neither NAF nor ITT, now a defense electronics manufacturer, would comment on Schober's assertions.

BUSINESS STRATEGY

Haydock, NAF's managing director, says that from the outset, it tried to familiarize corporations and their attorneys with the benefits of arbitration over court cases. NAF isn't alone in doing this. AAA and JAMS also place ads in legal publications and sponsor events at bar association meetings.

But NAF goes further. On some occasions, it tries to drum up business with the aid of law firms that represent creditors. Summaries of weekly NAF business development meetings from 2004 and 2005, which are labeled "confidential," show it enlisted Wolpoff & Abramson and another prominent debt collection law firm, Mann Bracken, to help win the business of companies such as GE's (GE) credit-card arm. When creditors succeed, the law firms seek fees of 15% or 20% of awards, which are added to judgments and billed to debtors. Atlanta-based Mann Bracken surfaces in a November, 2004, NAF document that states: "Work with Mann to begin its taking lead on GE as it relates to Mann running the program for it."

The same NAF document describes efforts to collaborate with Mann Bracken and Wolpoff & Abramson to recruit Sherman Financial Group as an arbitration customer. Sherman, based in Charleston, S.C., buys delinquent debt from major credit-card companies at a discount and then tries to collect on it. Under the heading "Last Week's Single Sales Objective," the NAF document notes that Wolpoff & Abramson and Mann Bracken partner James D. Branton are to host a panel discussion with attorneys for Sherman Financial. "Follow-up w/ Branton and Wolpoff after conference," the document adds.

The strategy appears to have worked. Sherman confirms that Mann Bracken has represented it in collections cases before NAF. But Sherman denies that either law firm solicited its business on behalf of the arbitration firm.

A former NAF staff employee familiar with its business development efforts says: "It was well understood within NAF that working through established collection law firms was an effective way to develop business with creditors." Insisting on anonymity, the ex-employee explains that, since Wolpoff & Abramson and Mann Bracken had strong ties to major credit- card companies, the law firms could boost NAF's chances of getting creditors to use its services. All told, documents from four NAF business development meetings from October, 2004, through August, 2005, refer 36 times to Wolpoff & Abramson, Mann Bracken, and their attorneys in connection with pitches to credit-card providers and debt buyers.

An arbitration company collaborating with law firms to land business troubles some legal scholars. "Most people would be shocked," says Jean Sternlight, an arbitration expert at the University of Nevada, Las Vegas. "Our adversarial system has this idea built into it that the judge is supposed to be neutral, and NAF claims that it is," she adds. "But this certainly creates a great appearance, at a minimum, of impropriety, where the purportedly neutral entity is working closely with one of the adversaries to develop its business."

"STREAMLINING" THE PROCESS

Mann Bracken's Branton declines to discuss specific clients, citing confidentiality agreements. In an e-mail, he adds: "Mann Bracken frequently and openly works with arbitration administrators (including the National Arbitration Forum and the American Arbitration Assn.) to assist our clients in developing legal solutions tailored to their needs. This is very similar to the work we do with court clerks across the country in streamlining the litigation process for our clients."

NAF's rivals, AAA and JAMS, say they don't cooperate with debt collection law firms in this manner. "Those who inquire about filing cases with us, which include individuals, governmental entities, and businesses, often reach out to understand how to use our online filing process, which is available to all parties," says AAA spokesman Wayne Kessler. The firm says it handled 8,358 consumer arbitration cases in 2007, far fewer than NAF. JAMS says it doesn't handle such cases.

NAF arbitrators say they aren't familiar with all the ways the company markets itself. When told about the internal documents, however, several expressed concern. "Using a law firm to actually solicit business for [NAF] raises a question of the appearance, at least, of potential impropriety," says Edwin S. Kahn, a lawyer in Denver who advocates for low-income families and, as a sideline, has handled about 30 NAF cases and 50 AAA cases. Kahn says he is considering recusing himself from cases involving Mann Bracken and Wolpoff & Abramson: "I have learned something that might affect my objectivity."

NAF interprets Kahn's comments as showing that "he is very aware of his professional responsibility to remain entirely neutral." It adds that it has "been successful in completely isolating the independent arbitrators from educational and marketing efforts used to encourage the use of arbitration."

Edward C. Anderson, an NAF founder and past CEO, confirms that the company does "educate" creditors' lawyers on the benefits of arbitration in hopes that the lawyers' clients will purchase NAF's services. He sees no conflict of interest. "The documents that you have apparently relate to meetings with particular lawyers," he says. "It looks to me like we pitched these lawyers on the efficacy of arbitration for their clients, and they have to decide what works for them." Mann Bracken and Wolpoff & Abramson decline to comment.

GE confirms that it employs Mann Bracken and says consumers may resolve disputes before NAF or AAA. Consumers also may opt out of GE's arbitration clause, although relatively few do. In a statement, GE spokeswoman Cristy F. Williams says that when the company initiates collection actions, "it has historically always filed in a court of appropriate jurisdiction." She adds that GE's arbitration clause referring to NAF was in place before the 2004 and 2005 references to Mann Bracken in the NAF documents. GE declines to respond to questions about the overall fairness of NAF arbitration or on Mann Bracken's role in aiding NAF to gain arbitration business.

EASING THE COURT'S LOAD

Most judges are favorably disposed toward arbitration as a way of alleviating the courts' litigation load. In one case in which customers questioned the use of an arbitration clause by credit-card issuer First USA Bank, a federal judge in Dallas ruled in 2000: "The court is satisfied that NAF will provide a reasonable, fair, impartial forum."

But some courts have found reason to question NAF awards. In May, 2005, a state judge in Oregon threw out a $16,642 arbitration judgment favoring MBNA. Judge Donald B. Bowerman didn't explain his reasoning, but the consumer in the case, Laurie A. Raymond, had appealed the award, saying she had been complaining to MBNA since 1990 that the charges attributed to her were the result of fraud or a mistake. Raymond, a 54-year-old family-law attorney in Portland, also told the court that she had never signed an arbitration agreement. Unlike most alleged debtors, Raymond energetically disputed NAF's jurisdiction. The credit-card company at certain points in the past had conceded that she didn't have to pay, she says. Nevertheless, in July, 2004, the arbitrator entered the award for the bank without holding the hearing Raymond says she had requested.

After Raymond got the award canceled, she sued MBNA for violations of debt collection and credit reporting laws. MBNA settled the suit on confidential terms. MBNA parent Bank of America declines to comment specifically, citing privacy obligations. "The referral to arbitration was consistent with the practices in place at the time," the bank says. "We believe arbitration can be an efficient and fair method of resolving disputes between our customers and the company."

NAF declines to comment on the Raymond case. But generally, the company adds: "Litigants, on either side, do not always see the facts, the law, or the process through an unbiased eye."

Raymond felt equipped to take on NAF and MBNA because of her legal training, she says. "One reason I went on with the process was that if [NAF] can do this to someone who understands this stuff, what are they doing to the little grandma next door?"

Cheryl C. Betts of Cary, N.C., was one layperson who felt overwhelmed. She learned that she'd been taken to arbitration in May, 2007, when Mann Bracken sent her a letter about $6,027 she owed on a Chase credit card. The letter informed her that she'd have to pay an additional $602 in legal fees related to arbitration but offered to settle for 75% of the total, or $4,972. Betts, a 55-year-old former administrative assistant for an energy company, says she always intended to pay her debt but didn't want to cough up nearly $5,000 at once. "I'm not a deadbeat," she says.

Betts says her troubles began after she was late with one $128 minimum payment in August, 2005. Chase lowered her credit limit from $6,000 to $4,900. Fees and penalty interest soon pushed her over that limit, setting off a spiral of rising minimum- payment demands that she says she couldn't afford. Betts says she repeatedly contacted the bank to try to work out a payment plan. "This should never have happened," she says.

Chase declines to comment on particular credit disputes, citing customer privacy. The bank points to a 2000 opinion by U.S. Supreme Court Justice Ruth Bader Ginsburg saying that "national arbitration organizations have developed similar models for fair cost and fee allocation.... They include National Arbitration Forum provisions that limit small-claims consumer costs."

The May, 2007, letter to Betts from Mann Bracken announcing its intention to arbitrate set off a nine-month flurry of paperwork. In August, after she filed an 11-page response to the arbitration claim, Mann Bracken requested an adjournment, which was granted. Four months later, Betts fired off a long fax further disputing the case, and the law firm responded by seeking a 45-day extension. Betts thought she would have another opportunity to contest the case.

But on Feb. 15, 2008, the day after the extension expired, an NAF arbitrator issued a ruling ordering her to pay $5,575 to Chase. She has taken the case to a state court in Raleigh. "Many people," she says, "would have thrown in the towel because they don't have the time to pursue this, or they are just totally confused.... The only thing that kept me going was that I knew that I hadn't done anything wrong."

NAF declines to comment on the Betts case but reiterates that its procedures are fair. It adds that "parties can become confused about court procedures or about arbitration procedures.... "

Join a debate about regulating credit card rates.

Berner is a correspondent for BusinessWeek in Chicago. Grow is a correspondent in BusinessWeek's Atlanta bureau.

With Susann Rutledge

http://www.businessweek.com/magazine/content/08_24/b4088072611398.htm

|

Home

Home  Home Buyer Resources

Home Buyer Resources  Contracts & Arbitration

Contracts & Arbitration  Banks Win in Arbitration

Banks Win in Arbitration  Home

Home  Home Buyer Resources

Home Buyer Resources  Contracts & Arbitration

Contracts & Arbitration  Banks Win in Arbitration

Banks Win in Arbitration